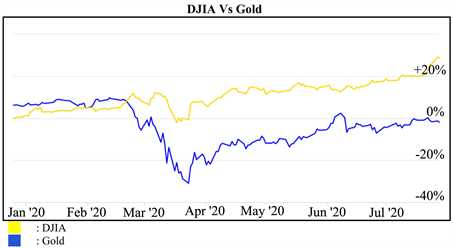

Gold can be seen as extra stable, silver has the next volatility price (making it more attractive to those who can tolerate fluctuations for larger rewards), and platinum has the potential for increased growth rates due partly to its industrial uses. The expansion and return in a gold mining inventory depends upon the anticipated future earnings of the company in addition to on the worth of gold. The great things that include an IRA custodian precisely trust firm are that they know the very best methods to take a position and take care of your cash in today’s finance marketplace for an enjoyable tomorrow. Everyone knows how briskly the years can go by so do one thing about it now earlier than things get tough and it is too late. The IRS requires you to withdraw a minimal quantity annually from a gold IRA whenever you attain the age of 70 1/2. American Hartford Gold website has an easy-to-use device for estimating your minimal distribution requirement. When you get an account set up, it is possible for you to to invest retirement funds immediately into gold and silver coins and bullion. You will be asked for the type of account you wish to open (i.e., traditional or Roth IRA), best IRA gold companies adopted by your personal and contact data. The answer to that query came with the market meltdown of 2008 when the typical stock fund fell a whopping 38 percent and retirement accounts lost $2 trillion worth of worth in 15 months: And it was a resounding “no,” paper isn’t sufficient. Account holders may also chat with a crew of professional gold advisors that can reply any questions and help them make sensible choices about when to purchase valuable metals and the way to take a position to perform their retirement objectives.

Gold can be seen as extra stable, silver has the next volatility price (making it more attractive to those who can tolerate fluctuations for larger rewards), and platinum has the potential for increased growth rates due partly to its industrial uses. The expansion and return in a gold mining inventory depends upon the anticipated future earnings of the company in addition to on the worth of gold. The great things that include an IRA custodian precisely trust firm are that they know the very best methods to take a position and take care of your cash in today’s finance marketplace for an enjoyable tomorrow. Everyone knows how briskly the years can go by so do one thing about it now earlier than things get tough and it is too late. The IRS requires you to withdraw a minimal quantity annually from a gold IRA whenever you attain the age of 70 1/2. American Hartford Gold website has an easy-to-use device for estimating your minimal distribution requirement. When you get an account set up, it is possible for you to to invest retirement funds immediately into gold and silver coins and bullion. You will be asked for the type of account you wish to open (i.e., traditional or Roth IRA), best IRA gold companies adopted by your personal and contact data. The answer to that query came with the market meltdown of 2008 when the typical stock fund fell a whopping 38 percent and retirement accounts lost $2 trillion worth of worth in 15 months: And it was a resounding “no,” paper isn’t sufficient. Account holders may also chat with a crew of professional gold advisors that can reply any questions and help them make sensible choices about when to purchase valuable metals and the way to take a position to perform their retirement objectives.

Lastly, GoldBroker presents clients a user-friendly on-line platform and professional recommendation on investing in gold and silver. GoldBroker is the top choice for these on the lookout for the best gold IRA companies. Some of the best IRA gold companies will waive this payment for bigger preliminary investments. Among the many various array of investment choices, the Gold Individual Retirement Account (IRA) is rising as a beacon for best IRA gold companies savvy enterprise homeowners. Patriot Gold does not have a separate itemizing with the BBB. Higher Enterprise Bureau (BBB). These investments all rely on the efficiency and integrity of monetary instituions, global governments, business practices, and world occasions. Uncover the benefits of Joining Gold Alliance As we speak – Unlock a World of Alternative! One-, 10- and 100-ounce bars are in style. Despite primarily being a gold IRA company, Goldco also sells treasured metals directly to customers and they will both ship it to your handle or retailer it on your behalf. If you want to diversify your holdings while investing in coins with potential numismatic value as collectibles, Oxford Gold Group is an efficient firm to work with. Then, you’ll want to look for a corporation with the bottom fees possible while nonetheless offering a excessive degree of buyer assist. If you happen to want help with a rollover or best IRA gold companies switch, Gold IRA companies shall be accessible to help you through each step of the way in which.

Lastly, GoldBroker presents clients a user-friendly on-line platform and professional recommendation on investing in gold and silver. GoldBroker is the top choice for these on the lookout for the best gold IRA companies. Some of the best IRA gold companies will waive this payment for bigger preliminary investments. Among the many various array of investment choices, the Gold Individual Retirement Account (IRA) is rising as a beacon for best IRA gold companies savvy enterprise homeowners. Patriot Gold does not have a separate itemizing with the BBB. Higher Enterprise Bureau (BBB). These investments all rely on the efficiency and integrity of monetary instituions, global governments, business practices, and world occasions. Uncover the benefits of Joining Gold Alliance As we speak – Unlock a World of Alternative! One-, 10- and 100-ounce bars are in style. Despite primarily being a gold IRA company, Goldco also sells treasured metals directly to customers and they will both ship it to your handle or retailer it on your behalf. If you want to diversify your holdings while investing in coins with potential numismatic value as collectibles, Oxford Gold Group is an efficient firm to work with. Then, you’ll want to look for a corporation with the bottom fees possible while nonetheless offering a excessive degree of buyer assist. If you happen to want help with a rollover or best IRA gold companies switch, Gold IRA companies shall be accessible to help you through each step of the way in which.

Since numerous depositories have differing storage charges, having a selection within the matter can save you some cash in your annual IRA prices. Once you’ve got discovered the best treasured metals seller, name them or electronic mail them expressing your curiosity in opening an account. The necessity for silver won’t ever decline. As you plan your retirement investments, be sure to perceive the Roth IRA, as a result of it forms a core choice in your investing toolkit. The simplest strategy to do it’s to roll over the property from a 401(Okay) plan after leaving a present job. Investing in gold may be a great approach to diversify your portfolio and protect your property from inflation. One among the great issues a few Precious Metals IRA is that it allows traders to diversify their portfolios past traditional investments like stocks, bonds, and mutual funds. Primarily, this means that you can only purchase uncooked bullion on your gold IRA, in the form of either bars or qualifying coins. Like every investment, gold can go up or down in worth.